you meant as someone with $44k STG?

oh no! do you have more? did I fail your purity test for STG ownership? allow me to get on a knee and bow to you oh grand master of STG tokens. May I fetch you something my grand master worshipfulness? an evian perhaps?

Definitiely no to this unfair deal. Whoever behind this proposal should be sued for financial frauds

This is an epic DAO thread. In 3000 years, Chinese AI robot warlords will analyze this event.

Initial Analysis: Stargate Valuation & M&A Market

Relayzero is pleased to share some preliminary analysis on how we should think about valuing Stargate in the context of the LayerZero offer and Wormhole’s expressed intent to counter.

Valuation

-

Offer Market Cap: $110.6M (based on 660.5M STG in true circulation × $0.1675 offer price).

-

Treasury (ex-STG): ~$95M in stablecoins, ETH, and other assets.

-

Enterprise Value (EV): $110.6M – $95M = ~$15.6M.

Protocol fee data (DefiLlama): Last 30d fees ≈ $180K → annualized ≈ $2.16M.

This means the Enterprise Value (EV) Revenue Multiple = ~7.2× annualized revenue.

Note: this does not account for the proposed 6mo rev share for veSTG holders.

View google sheet calculations here.

How This Fits M&A Market Multiples

-

In M&A, protocols and companies are usually priced on revenue multiples.

-

High growth projects**:** 10–15× revenue

-

Slower/lower growth projects**:** 5–10× revenue

-

-

Stargate’s revenue growth has been declining over the past 12 months, making a ~7× multiple a reasonable starting point for an offer.

For context, the public stock market (especially in the U.S.) is at all-time highs — with median multiples around 30×, driven heavily by AI stocks. Crypto M&A does not trade at those levels because revenue is still narrow and highly variable.

However, valuation is about payback period and how much long-term revenue growth a buyer believes they can capture. With the entrance of Wormhole, we can easily see a bidding war that drives up multiples - a big win for token holders. As of yesterday, STG traded at $0.1772 which is an expected 6% premium over the original offer and 10x revenue.

| Multiple | EV (Revenue × Multiple) | Token Value (EV + Treasury) | Token Price |

|---|---|---|---|

| 7.24× | $15.64M | $110.64M | $0.1675 |

| 10× | $21.60M | $116.60M | $0.1765 |

| 12× | $25.92M | $120.92M | $0.1831 |

| 15× | $32.40M | $127.40M | $0.1929 |

| 30× | $64.80M | $159.80M | $0.2419 |

Strategic Upside Considerations

If Wormhole or any other buyer believes they can gain market share by owning Stargate, that means more revenue and possibly pricing power. For example, Stargate has significant volume on Arbitrum. Is this a market, Wormhole or other bidders want to enter or grow market share?

There may also be hidden revenue opportunities:

-

Fee switches not turned on.

-

Potential to adjust fee split between protocol and LPs.

-

Fees on the stargate website or consumer apps.

-

New products or integrations that monetize the messaging layer more deeply.

These upside levers would justify a higher multiple.

Alternative Pricing Mechanisms

-

In consumer tech, valuations evolved to be based not just on revenue, but on users.

- Facebook popularized DAU (daily active users). Coinbase and others in crypto are now reporting MTA (monthly transacting accounts) which indicates a similar intent.

-

In this model, market cap is a function of revenue potential per user — which may ultimately be a better measure for cross-chain infrastructure than just one way to protocol makes money today.

Other Considerations

-

In all token like all equity deals, sellers generally can dictate a higher multiple than all cash deals.

-

As this is a token swap and liquidity of tokens can vary widely and the potential for insider trading, setting an offer priced based on a premium on a 30d VWMA may be wise.

-

An overview on the plan for the protocol and teams working on these protocols, will be critical for operational buy-in from bidders like Wormhole.

-

IP and other assets owned by the DAO not living onchain may affect the valuation.

-

Post-closing governance and risk mitigation may add risk here. See FEI-RARI token merger.

-

Wormhole’s due diligence request is reasonable and token holders should push for disclosure. If this were a public company, the board would have a fiduciary duty to equity holders to pursue the best financial outcome.

Exit Market Fit

Like companies and their founders, protocols also need to find the right buyer. A buyer should align culturally and strategically on the big idea - what we call “Exit Market Fit”.

-

What is Stargate’s vision? Is it simply to be the bridge for all onchain assets? If so, both LayerZero and Wormhole are natural fits.

-

Or is there a more nuanced, unwritten promise — shared vision and alignment with LayerZero’s founding team?

Exit market fit isn’t just about price — it’s about cultural alignment, vision, and operational execution. Token holders should consider both numbers and narrative.”

Recommendations:

-

Disclose everything (wallets, assets, revenue, veSTG).

-

Delay the vote to attract additional bidders.

-

Set a community-governed auction framework with VWMA-based pricing.

-

Hire an independent M&A advisor.

Closing Thought

The numbers tell us this offer values Stargate at ~7× revenue. That’s within reason, given declining growth — but not the whole story. The ultimate question is: who can best unlock Stargate’s strategic upside, align with its long-term vision, and fairly capture the value of its treasury, protocol, and community?

Regardless of whether Wormhole submits a bid, the community and controlling voting interests can and should negotiate. This is your deal to decide.

P.S. - Relayzero is not your attorney, financial, or tax advisor. The analysis provided herein is for informational and educational purposes only. Relayzero and its team hold no STG, ZRO, W or related tokens as of this post.

WATCH Unchained Live Analysis with Laura Shin, David Nage (Arca), and Lawson Bae (Relayzero) - HERE

Why don’t you focus on improving your own product instead of tarnishing and smearing the reputation of other projects — especially those that are considered market leaders and have already proven their full capability and responsibility in managing their product, both technically and in terms of their stock performance?

No matter the size of the value you propose, you could invest it in building a technology that is at least comparable and technically solid.

How can the community trust you and your product, when in reality it has brought nothing but hardship to its own community?

You speak of a “win–win” situation — but where exactly is the win for your community???

As is often the case in politics, it’s the minority that decides for the majority. There are about 64 million veSTG, but only 7 million vote. So, less than 5% of holders decide because they actively participate in the decisions and decide to plunder the project. It’s sad…

Funding Wallet: Address: 0xab192f58...5f39aab47 | Etherscan

We have a lot of respect for the Stargate community, and are eager to work with the Stargate team to make a fair deal for STG holders. While we continue our ongoing diligence efforts (we are still waiting on information from the Stargate team), we wanted to put to rest the notion that Wormhole is not serious about making an offer, as well as assuage concerns of existing Stargate partners that they will lose any access or privileges they currently enjoy.

Relying solely on the existing bid of $110 million (ZRO tokens), we are prepared to make an offer of at least $120 million (USDC) for Stargate. An all-cash purchase provides STG holders with the greatest certainty of what they will be paid without delay.

Growing Stargate Post-Acquisition

Wormhole contributors and partners are actively planning the next steps after acquiring Stargate. Completing the acquisition of Stargate would be complementary for many of our existing products, and even more so for two of our in-development projects that are yet to be announced.

Be assured that we see numerous opportunities to grow and leverage Stargate through premier partnerships. One example is real-world assets, where Wormhole is a leader with assets like BUIDL from Blackrock, ACRED from Apollo, funds from Hamilton Lane, leading stablecoins, and many more. We view Stargate as an asset that has not been provided the resources it needs to grow, and we intend to correct that. With the proper resources, Stargate can provide more value to users and continue to improve its product.

Pledge To Honor Stargate Commitments

Further, Wormhole intends to leave in place and honor commitments made by Stargate to counterparties, integrators, and contributors for a minimum of 12 months. Identifying all documented commitments is part of our ongoing diligence process.

Our offer would also ensure that current veSTG holders receive 3x the projected revenue for the next 6 months, accelerated and paid immediately, as part of our successful acquisition.

Due Diligence

We urge the Stargate Foundation, STG holders, and voters to allow a competitive bidding process, rather than proceeding with a lower offer. As a responsible actor, Wormhole must conduct reasonable due diligence for an acquisition of this size.

We are finalizing the details of an NDA, and in parallel the Stargate team is preparing the first group of diligence documents we have requested.

We are not requesting any trade secrets, client lists, future development plans, or similar information. Our primary objective is to verify the assets, liabilities, and obligations of Stargate, enabling us to submit the highest possible bid for the best outcome for both Wormhole and Stargate.

We want to remind STG holders and the Stargate Foundation that there is little to lose by allowing a few additional days for a competitive bidding process. The worst that can occur with such a process is the initial offer is accepted a week later than it otherwise would be. By contrast, a quick sale to a related party on a low valuation prevents STG holders from realizing the fair value of their tokens.

Initial Funding

The Wormhole Foundation has arranged financing for this transaction, subject to negotiation and execution of definitive financing legal documentation and the financing party’s satisfactory completion of operational, financial, and legal due diligence. To demonstrate its seriousness, this party has moved initial adequate funds into its segregated wallet identified above.

This is just a start, and we are prepared to engage in a fair bidding process.

I give my full support to this offer from Wormhole and believe that the DAO should do whatever it can to stop the current proposal from going through. It would be nonsensical from the standpoint of a veSTG holder to proceed any other way.

I fully support this proposal.

Mostly because it’s really funny.

Even though I have repeatedly stated that LayerZero’s offer is too low and that I voted against this sale, I do not believe that their offer makes sense unless Wormhole comes back with an offer in the range of $150-200 million.

If this sale goes through, due to the connection between the two companies, it would not be right to sell to another entity other than LayerZero for $5-10 million.

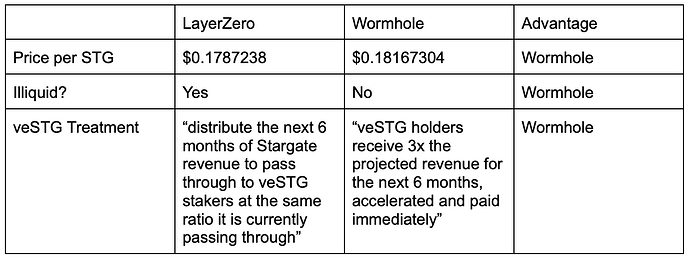

To illustrate the benefit of a cash offer, let’s compare the main components of the current offer from LayerZero and the numbers we provided today.

We also want to draw attention to the improved revenue sharing for veSTG holders, which we have tripled.

We believe the offer from LayerZero to be at a disadvantage in all areas.

We show our work below:

Circulating supply of STG: 660,527,273.44 (Source: Aug 4th Treasury Report)

Wormhole lump sum: 120,000,000 USDC

LayerZero lump sum: 0.08634 ZRO per STG

ZRO price today: $2.07 (Source: Coingecko)

STG price today: $0.1799 (Source: Coingecko)

Wormhole per token:

(120,000,000 USDC) / (660,527,273.44 STG) = $0.18167304

LayerZero per token:

($2.07 price) * (0.08634 ZRO) = $0.1787238

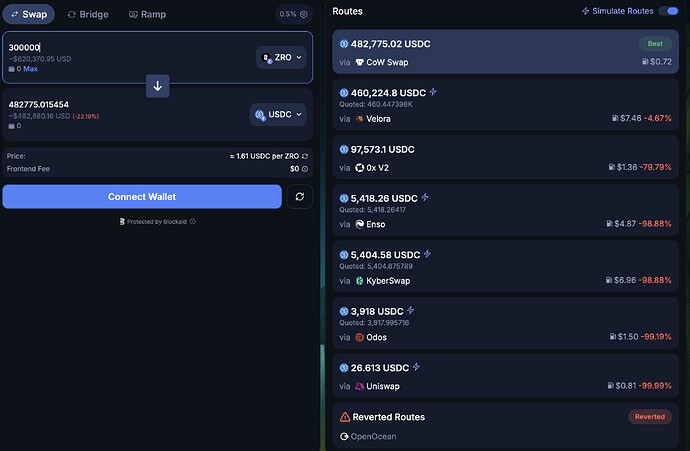

ZRO also suffers from low liquidity, with slippage occurring well below a $1m swap in DeFi.

You can’t even get your own project in order, so why do you need Stargate? It’s obvious you just want to hinder L0’s expansion. Also, look at your liquidity W holders can get 90k USDC on base for 500k $ worth of tokens ![]()

I have been DMed by many parties suggesting that Across Protocol should participate in this process. I have no interest in rushing an 11th hour proposal, however if this process is slowed down and other bids are properly considered, Across will participate.

I do honestly believe it would be in the best interests of Stargate holders to run a proper process with other bidders.

The Axelar Foundation would like to express its strong interest in participating in this process.

- Stargate stands to benefit significantly from Axelar’s decentralized interoperability infrastructure. Assuming alignment at both the technical and economic level, Axelar Foundation is ready to allocate resources to strengthen Stargate’s security, expand its reach into ecosystems not currently accessible via LayerZero (including Sui and Ripple), and dedicate technical resources to accelerate Stargate’s growth.

- Under the current acquisition proposal, Stargate’s enterprise value is set at $15M (we are referencing RelayZero’s earlier message, as we have not yet completed a full economic analysis, though this appears consistent with our preliminary review). We believe the economic upside of aligning Axelar and Stargate on both the technical and economic fronts is substantially higher, and therefore we are very interested in pursuing a proposal.

- If a competitive process is initiated for the Stargate acquisition, we would be very interested in preparing a comprehensive proposal and encourage Stargate to collect all options before making a decision.

@WormholeFDN @hal2001 @AxelarFoundation

After purchasing the necessary STG and staking it, create a Snapshot proposal referencing Discourse thread EMERGENCY PROPOSAL: Independent Sale Process for Stargate, the $120M USDC cash bid, and frame it as an emergency fast-track with a 12-hour voting period to pause the LayerZero vote and initiate an independent sale process.

This proposal already has completed the 7 day discussion period, meaning according to DAO rules it should be posted on snapshot, especially considering the existential nature of this proposal and the positive support in the thread.

RECOMMEND: PAUSE, DISCLOSE, & CREATE OPEN BIDDING PROCESS

There are now two official bids (LayerZero and Wormhole) and two formal intents to bid (Axelar and Across).

Recommendations:

-

Pause voting on the current proposal, or vote against this proposal, until a transparent bidding process is in place.

-

Disclose all material information to qualified bidders signing an NDA. Given LayerZero’s close association with Stargate, disclosure should err on the side of being very thorough — including, but not limited to the following information for both the protocol and foundation.

- Balance Sheet and PnL for 3yrs + YTD

- List of all IP assets

- DAO treasury wallet addresses and balances (including stablecoins, ETH, STG, LP tokens)

- List of any liabilities

- List of any pending lawsuits or regulatory actions

- Proprietary data relating to protocol (e.g. protocol traffic)

- Protocol owned liquidity and contracts with any liquidity providers

- List of team members, titles, and total burn

- All contracts especially those with LayerZero for support and development

- Multi-sig wallet addresses and list of signers including contracts relating to protocol upgrades and variable changes

- Create a proposal for an open bidding process to standardize:

- Token offer price for STG

- Offer for veSTG holders

- Proof of funds or financing and settlement mechanics (cash vs token consideration)

- Future plans for Stargate’s brand, team, and protocol

- Mechanism for submitting and evaluating bids (Snapshot, community committee, or auction framework) with a minimum of 5 days of due diligence

- Other closing logistics and transition plan

- Conflicts of interest disclosure and certification

This ensures parties can evaluate bids on equal footing and maximizes competitive tension — the best way to deliver fair value for the community.

Thank you for your comment and participation.

As has been confirmed previously in this discussion, Snapshot votes cannot be paused.

The Stargate Foundation has been engaging with any parties interested in signing an NDA and moving through the DD process.

Honestly, it’s a bit ridiculous. When Stargate was struggling, none of the competitors cared, none of them showed up. Now that they see a chance to profit, suddenly those same competitors are rushing in like they’ve supported Stargate all along. Aside from LayerZero, the sudden bandwagoning doesn’t look great.

Stargate is not something to be taken lightly. “Wormhole, Axelar, Across“